is there a death tax in texas

Texas Estate Tax. However there is still a federal estate tax that applies to all property that exceeds the 1206 exemption bar if a person has deceased after January 1 2022.

It consists of an accounting of everything you own or have certain interests in at the date of death.

. In some states individual inheritors are charged a state inheritance tax on top of federal inheritance taxes. The state also has ruled that adopted children have the same inheritance rights as biological children. Does Texas Have Its Own Estate Tax.

This includes children who were adopted as adults. No not every state imposes a death tax. Prior to September 15 2015 the tax was tied to the federal state death tax credit.

So a married couple gets two step-ups one at the time of the first spouses death and another at the time of the second spouses death. Texas does not have an estate tax either. And some states levy inheritance taxes on people.

Texas does not levy an estate tax. The federal estate tax is a tax on your right to transfer property at your death. At the state level there is not an estate tax in Texas to be concerned about by anyone but at the federal level there is.

This is because even though an estate tax still. There is a federal tax where the IRS taxes portions of your estate. The only types of taxes that apply in Texas after a person dies are income taxes gift taxes property taxes and federal estate tax.

After the homeowners death if the estate. And depending on where you live there may be state-level taxes due as well. Six additional states also levy an inheritance tax.

If you do not make a will prior to your death according to the sucession plan of the state of Texas stepchildren. Texas is one of the states that do not collect estate taxes. 108 - 12 Inheritance tax.

While Texas does not impose a state inheritance or estate tax if you die without a will your assets will be distributed through the states intestate succession process. There are two main types of death taxes in the united states. Death Taxes in Texas.

Inheritance Tax Laws in Texas. Biological children have strong inheritance rights in the state of Texas. In addition to taxes due at the federal and state level there is also another tax known as an inheritance tax.

What Is the Estate Tax. 71 million Estate tax rates. Call or Text 817 841-9906.

The federal government and some state governments impose estate taxes on decedents estates. Only 12 states plus the District of Columbia impose an estate tax. The estate tax sometimes referred to as the death tax is a tax levied on the estate of a recently deceased person before the money passes on to their heirs.

While there is no state inheritance tax in Texas your estate may be subject to the federal estate tax. UT ST 59-11-102. However less than 1 of the population in Texas or even in the United States needs to worry about this.

Then the estate must pay the taxes interest and penalties. Therefore the estate will have a death tax liability of 40 x 620000 248000. Live Call Answering 247.

No Inheritance tax rates. Does every state impose a death tax. Tax is tied to federal state death tax credit.

This involves filing the decedents final income. A surviving spouse between the ages of 55 and 65 can keep the decedents exemption by applying at their local tax appraisal office. There are two types of estate taxes that can be imposed after death.

Any estate tax attorney will tell you that taxes are one of the most complicated aspects of probate and estate planning. There are not any estate or inheritance taxes in the state of Texas. In fact only New Jersey Nebraska Maryland Kentucky Iowa and Pennsylvania collect estate taxes.

Taxes levied at death based on the value of property left behind. The short answer is no. Inheritance and estate taxes are often grouped under the label death taxes Texas repealed its inheritance tax on September 15 2015.

It only applies to estates that reach a certain threshold. Tax was permanently repealed effective as of September 15 2015 when Chapter 211 of the Texas Tax Code was repealed. First there are the federal governments tax laws.

There is a Federal estate tax that applies to estates worth more than 117 million. One of your most important duties as executor or administrator which we will refer to here simply as an executor of a deceased persons estate is to look after the tax affairs of the decedent. The big question is if there are estate taxes or inheritance taxes in the state of Texas.

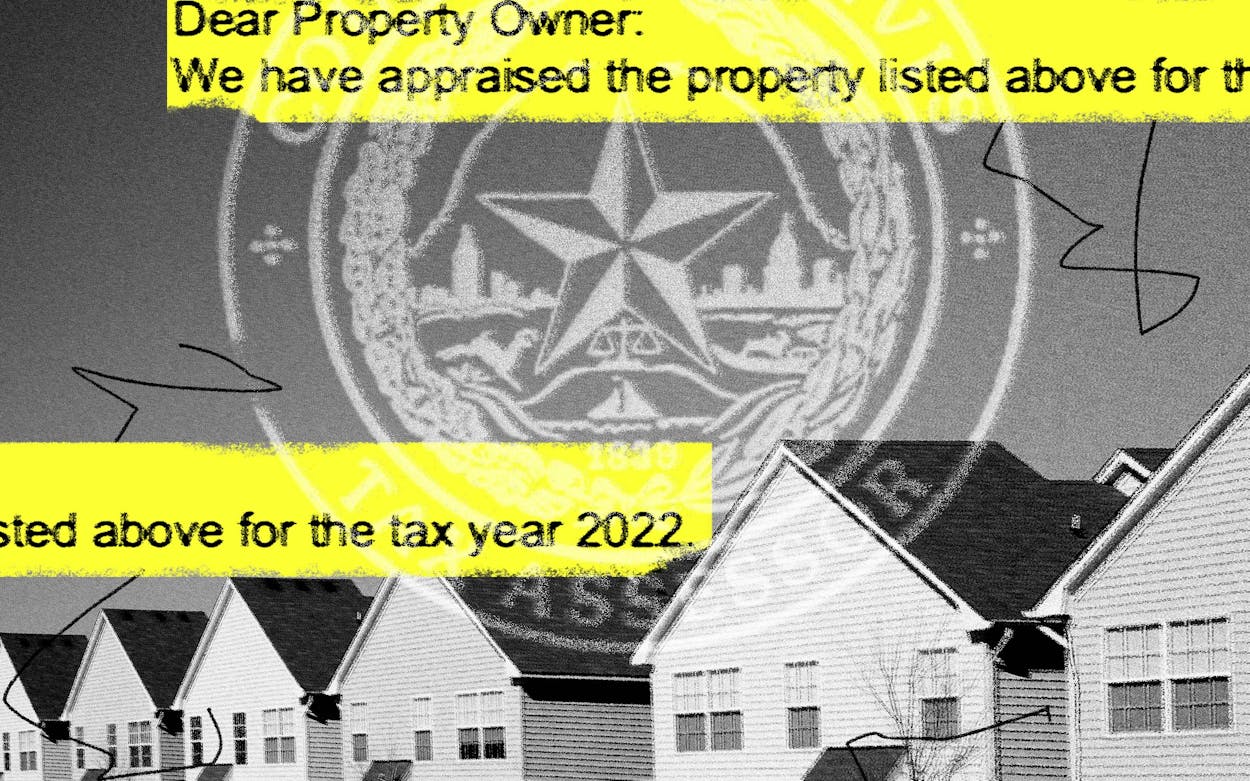

The taxes plus interest plus a penalty keep adding up until the elderly or disabled homeowner dies. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Texas also does not have an.

While Texas doesnt have an estate tax the federal government. The federal estate tax sometimes called the death tax is a one-time tax that is imposed at death. However other stipulations might mean youll still get taxed on an inheritance.

So long as the decedents estate is valued at less than. Estate taxes and inheritance taxes. It is one of 38 states with no estate tax.

Currently estates under 114 million are. Yes Estate tax exemption level. By Keith Hajovsky Mar 24 2021 Asset Protection General Estate Planning Trusts Wills.

There is a 40 percent federal. Inheritance tax also called the estate tax or death tax is levied at both the federal level and state level and applies to any assets transferred to someone other than the deceaseds spouse at the time of death. Intestate succession laws affect only assets that are typically covered in a will specifically assets that you own alone like real estate stock market investments businesses and other types of physical.

Theres no estate tax in Texas either although estates valued at more than 1206 million can be taxed at the federal level as of 2022. This final tax isnt anything that you or your estate would be.

Texas Monthly Teams With Hbo Hbo Max On Three Year Development Deal Variety

The Mckinney Examiner Texas History Historical Newspaper Newspaper Collection

Texas Massacre Is The Second Deadliest School Shooting On Record The New York Times

Texas Longhorns University Mark Poster Zazzle Com In 2022 University Of Texas University Texas Logo

Pin On News Articles About 1920s And 30s Gangsters

What Is The Probate Process In Texas A Step By Step Guide

Texas Massacre Is The Second Deadliest School Shooting On Record The New York Times

Texas Estate Tax Everything You Need To Know Smartasset

Real Estate Exam Cheat Sheet Real Estate Exam Real Estate Business Plan Real Estate Forms

Route Of Kennedy Motorcade Past Texas School Book Depository In Downtown Dallas Jfk Org Jfk Jfk Assassination George Bush

Texas Inheritance Laws What You Should Know Smartasset

Where Not To Die In 2022 The Greediest Death Tax States

What The Bleep Is Going On With Texas Property Taxes Texas Monthly